Make your child money smart

Ensure your child’s financial success with our simulation-based financial literacy program, paired with top tutors.

Why Choose GEMA?

Top 1% Global Educators

Futuristic Curriculum

Access to the Global Arena

Watch our students learning in action

Hi! I am Neha & I study in 3rd grade

Monthly Home Budget Tracker

Track your income & expenses with a worksheet. Plan your spending, savings and wants using rule of 50:30:20. Measure impact against ideal budget.

Hi! I am Rahul & I study in 4th grade

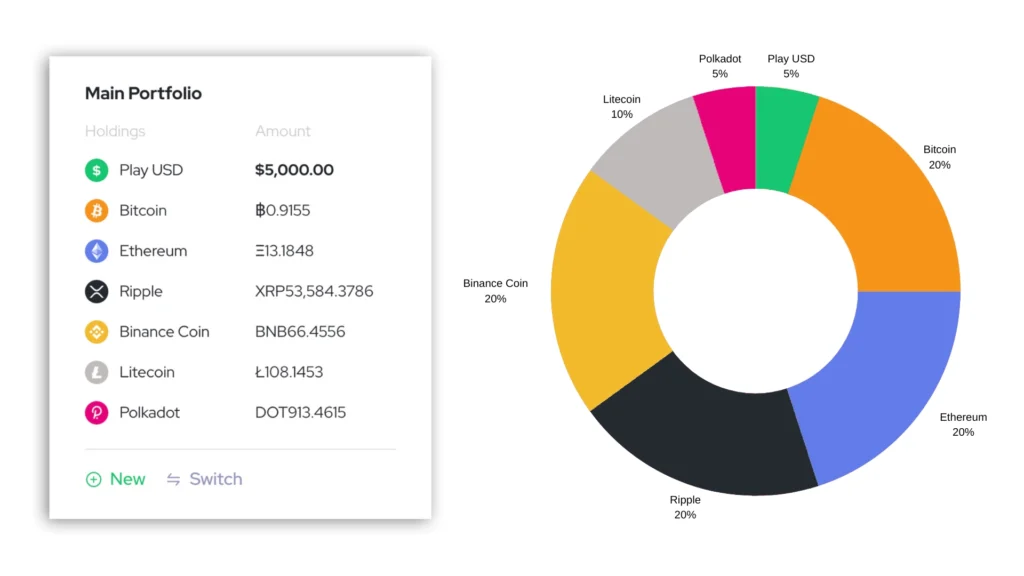

Virtual crypto market simulator

This simulator teaches users about the differences between Flat Money and crypto currencies, and the volatility of the crypto market.

Hi! I am Aditya & I study in 5th grade

Weekly Expense Tracker

Write down all your expenses and review them periodically. Using this expense tracker, the child learns about his/her spending habit.

Your kid's journey with GEMA

Basics of Money Management.

Introduction to Financial Market.

Introduction to Cryptocurrencies.

Money Mantras

Understanding Investment

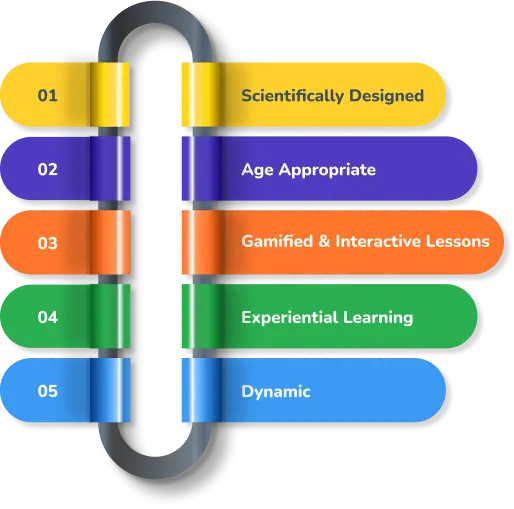

The 5 pillars of our curriculum

Looking for a curriculum that’ll transform your child into a genius? Look no further! Our hands-on program covers everything from money basics to crypto & entrepreneurship. Let’s ignite your kid’s inner financial spirit today with GEMA!

Checkout what GEMA'S class looks like?

Explore more of the GEMA universe

Research shows that kids start to develop the values, skills, and attitudes surrounding money and financial habits in early childhood. Teaching kids about money does not have to be a complicated process. Our curriculum is designed keeping in mind the grasping abilities of kids belonging to different age groups. This will not only help them gain crucial money management skills but also make them financially responsibile adults.

Here are a few points on how learning about financial literacy help your child:

1. Understand the difference between needs & wants

2. Learn about the value of money: how is money earned & why is it imporatant to spend it wisely

3. Develop insights on how can they make their money grow

4. Learn how to become financially independent adults

5. Protects kids from making wrong financial decisions & falling in debt

The course equips your child with new age finance skills through our scientifically designed curriculum that deploys the right mix of academics, games and activities to inculcate healthy financial habits in kids. The in-session activities (such applying Opportunity Cost Framework for effective decision making, playing Stock Market Simulations etc.), and Home Work Projects (which includes creating a Budget of Home, Expense Tracker, Fundamental analysis of stocks etc.) make sure that the concepts learned are applied in real life scenarios thereby reinforcing and internalization of concepts.